This is the second in a series of three articles exploring how we can improve the odds for our strategic investments by Quantifying Our Stories in Scenarios . . .

- Step 1: For Future Events

- Step 2: For Long-Term Cashflow

- Step 3: For Long-Term Cashflow Expectations at Earlier Horizons

Invisible Asymptotes

Benchmark Capital co-founder Bill Gurley recommended as “iconic” for “its lucidity, applicability, and therefore overall usefulness,” the concept of “Invisible Asymptotes” described by former Amazon strategic planner Eugene Wei:

It didn't take long for me to see that our visibility out a few months, quarters, and even a year was really accurate (and precise!). What was more of a puzzle, though, was the long-term outlook. Every successful business goes through the famous S-curve, and most companies, and their investors, spend a lot of time looking for that inflection point towards hockey-stick growth. But just as important, and perhaps less well studied, is that unhappy point later in the S-curve, when you hit a shoulder and experience a flattening of growth.

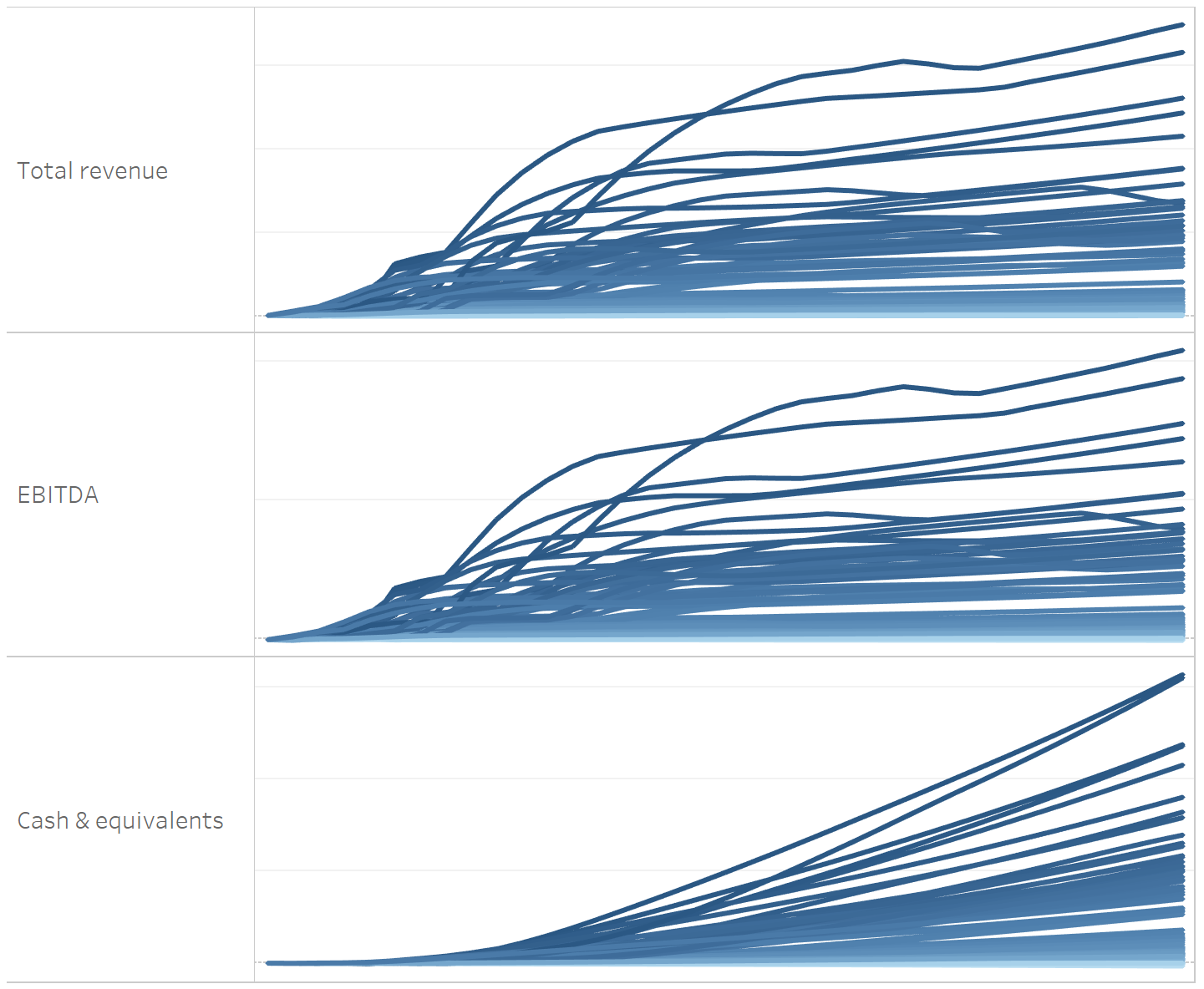

By producing many cases for events as illustrated in our previous article, Step 1: Quantify Stories in Scenarios for Future Events, we can drive cases for business model characteristics’ long-term asymptotes, such as those below (if you are reading on a smartphone, flipping to landscape mode helps with these interactive charts):

The Bullet Point Network Platform includes a Curve Model with intelligence built in to interpolate realistically from different cases for each characteristic’s long-term asymptote into different cases for its value over all intervening periods, such as years or quarters.

The charts below depict 100 cases for virtualgoods.shop’s future annual revenue in 3 target markets, from first and narrowest to last and broadest, based on the supporting evidence and judgments hinted at in the last article.

Notice that there are many cases where revenue’s asymptote is above zero in the first market segment, reflecting strong odds of a material value proposition there, but there are only about 15 cases where its asymptote is above zero in the last, largest market segment, reflecting only about 15% odds of a value proposition that represents a material improvement or radical improvement for that market..

Please click some curves to explore individual cases:

Long-Term Cash Accumulation

The Platform also includes an Integrated Financial Statements Model with intelligence built in to flex appropriately for different cases for these characteristics in order to produce cases for cash flow in future periods. This makes financial modeling flexible enough to amplify rather than hamstring the strategic thinking prized by managers like Wei and investors like Gurley.

Below, you can see that this is like a typical financial spreadsheet, except that it is not 1 to 3 arbitrary combinations assembled manually but instead 100 cases driven automatically from logical combinations of cases for drivers, with our odds for different combinations suggesting odds for different amounts of long-term cash accumulation. Please drag the dot at the top to explore more of these 100 combinations and their odds:

We can summarize these 100 cases for long-term cash accumulation as curves, which illustrate that cash flow can be more complicated than revenue. Please click some curves to explore individual cases:

In limited situations, cases for a company’s long-term cash accumulation are enough to serve as cases for our long-term return in an investment in the company, such as when . . .

- Near-term annual cash flow is very high relative to the investment’s price, typically when investors expect that cash flow will crater soon, otherwise known as a “distressed” situation.

- We have the luxury that our horizon is Warren Buffett’s favorite holding period of “forever.”

On average over the long-term, distressed investors and long-horizon investors have produced more profits than short-term investors, suggesting that it can be very advantageous to have the luxury to operate in these limited situations. Of the hundred wealthiest people in the world as listed by Forbes, only two—Jim Simons and Ray Dalio—are short-term investors, and even those two have made major investments in information systems that they did not sell in the short-term but instead may rely on to help them produce cash flow “forever.”

The Next Step

But hold on. Distressed high yield situations are few in today’s economic environment, and few of us have the luxury of a horizon as long as Warren Buffet’s “forever.” Usually we do not operate in these limited situations, so our future returns on an investment are dominated not by its cash flows but by the price at which we can sell it to someone else within our investment horizon. In those more typical situations, the Bullet Point Network Platform can help us all even more, as we illustrate in our next article, Step 3: Quantify Stories in Scenarios for Long-Term Cashflow Expectations at Earlier Horizons.