Will LPs’ quest for no-fee, no-carry returns result in increased adoption of a

hands-on investment approach, or will it result in a trail of LP tears?

By Pieter Nelissen and Mike Ryan, BPN Co-Founder and CEO

In May, the largest U.S. public pension fund plan, CalPERS, announced its plan to set up two funds to manage up to $13 billion to invest directly in leveraged buyouts. The move underscores a broader ongoing trend among institutional investors looking to lessen their dependency on consultancies and fund-of-funds, reduce fees, and claim a larger share of the gains in their private investments by “going direct.”

In 2017, CalPERS paid $689.6 million in base and profit-sharing to private equity general partners, on their roughly $27.0 billion private equity program (as of April 30, 2018)1. Quick math suggests a mere fraction of these fees would be substantial enough to attract top talent, establish and incentivize a new team of direct investment professionals, and put hundreds of millions (and likely billions of dollars compounded over time) back into the pockets of fund beneficiaries. Large U.S. and Canadian pension funds have led the charge in direct investing, but many more sovereign wealth funds, endowments and family offices are following suit in lemming-like fashion.

This trend raises a number of questions. Are these investors arming themselves with the necessary skills to take on this task? What size, scale, and expertise limitations do they need to consider? What additional competencies and analysis is necessary for traditional limited partners (“LPs”) to properly source and vet direct deal opportunities?

Private market investments have been the best-performing asset class for most institutional investors for decades, but this achievement has not come for free, nor is it necessarily easy for LPs to replicate. In this article, we discuss the increasing trend toward the pursuit of direct investments and consider what is necessary to equip LPs to take on these investments. Additionally, we contemplate whether the nine-year bull market has given the investment community a false sense of confidence in assessing their abilities to “go direct.”

How did we get here?

In the wake of the 2007-2008 financial crisis, a growing number of investors began to wake up to the misalignment of interests in the traditional institutional investor model. The traditional (passive) LP model is almost entirely outsourced and rarely possessed in-house expertise to properly diligence and execute financial transactions. Subsequent to the financial crisis, many LPs took a critical look in the mirror and reevaluated their passive roles. The trend among LPs since has been to increase their direct investment skill and continue to raise the bar on the level of complexity of investments they pursue.

Many LPs have elected to push their organizations toward more internally-oriented investment strategies to align with their longer-term objectives. It is exceedingly rare to find private sector asset managers willing to make decisions that will benefit a portfolio 20 or even 10 years in the future and going direct allows LPs that opportunity. In addition to the general dissatisfaction with third party manager fees, the ability to match assets with their liabilities and the opportunity to exert greater control of purchase and exit decisions have all been key catalysts in the move toward direct investing.

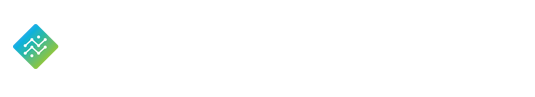

Bypassing intermediaries through the development of in-house investment professionals can offer a variety of benefits, such as improved net returns, better alignment of interest between investments and stakeholders, and access to investment opportunities. This push has also coincided with increased data availability for private markets investors, greater confidence in deal sourcing, and has been coupled with LPs interest in sectors or business areas that may benefit from their expertise. The chart below illustrates the growth of direct private equity deal volume led either by a single LP, partnerships, or joint venture/co-investments over the last 10 years.2

This trend toward direct investing has also led to greater LP connectivity and collaboration with other professional investors, including private equity firms. This transition has modified the objectives and operational DNA of internally-oriented LPs vs. their traditional, externally managed counterparts. “Going direct” thus requires an overhaul of many of the existing institutions’ processes; which means the transition to in-house asset management is much greater in scope than simply hiring a few dealmakers.

Family offices going direct

According to PEI’s LP Perspectives 2018, dedicated allocations to direct investments still remain small among LPs – around 14%. Additionally, of that 14%, more are likely to have defined direct investment allocations across private real estate, infrastructure and private debt than private equity.3

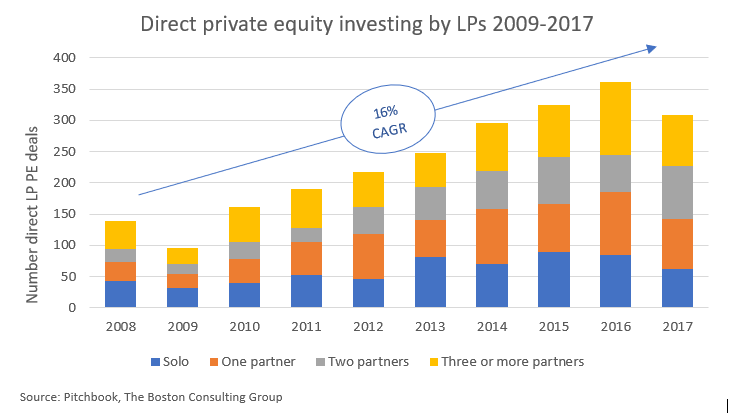

Among investor segments, family offices have increased substantially in wealth, sophistication, and the complexity of investments they pursue. According to the UBS/Campden Wealth Global Family Office Report 2017, family offices are more willing to accept illiquidity risk, particularly in North America where they have been rewarded for doing so. According to their latest survey of 262 family offices, the average family office portfolio size was $921 million, with direct private markets allocations ranging from 18%-24% in direct real estate to 4%-11% in direct venture and private equity depending on domicile (as shown in the chart below).4

Many family office investors look at direct investing as part of the ethos of the family, to encourage entrepreneurialism, invest in companies they expect to grow, and take a longer time horizon than private equity funds. A 2018 survey of family offices showed that 81% of these firms invest directly in real estate or operating businesses, with nearly half (47%) investing directly in an operating business. An additional 30% of the 109 family offices surveyed plan to increase direct investing during 2018.5

While closed-end private-equity vehicles typically own companies for five to seven years before cashing out, family offices can hold investments as long as they need to and are not under pressure from outside investors to exit their deals. Family offices have been highly motivated to invest on a co-investment or direct basis. However, the Global Family Office Report also noted that a number of family office respondents noted difficulties in finding suitable partners for direct investments and that their in-house resources may not be adequate when it comes to due diligence on these deals. In the absence of adequate resources, many family offices rely on personal networks or elect existing managers to co-invest alongside due to their due diligence capabilities. So the question then becomes what LPs could do better to ensure they are equipped to properly evaluate and monitor key decisions on their private markets investments.

Similar to family offices, many endowments and foundations see many alignments of interest in going direct, but continue to display varying appetites. Many of the leading large endowments and foundations opt to continue to invest through asset managers rather than developing in-house capabilities recognizing the costs and difficulties with a direct strategy.

Are LPs equipped to invest directly on their own

To consider going direct the first question is whether the requisite skill and expertise can be developed in-house; not only to source deals and execute a direct investment strategy, but also to monitor investments and drive key decisions on performance. Many view private markets as an equal opportunity space to create value, but unfortunately, this is simply not the case. Access to deal flow, domain knowledge, and good GP relationships are just some of the prerequisites to successful direct investing.

In the aforementioned UBS/Campden Wealth Global Family Office Report 2017, only 28% of family offices surveyed indicated it was easy to obtain external professional advice when looking to due diligence private deals. Having the resources and expertise to properly evaluate co-investment and direct opportunities in-house can be a significant hurdle. Having false confidence in your level of expertise at the ninth year of a bull market can also be detrimental to a portfolio.

Will the truly direct LPs please stand up?

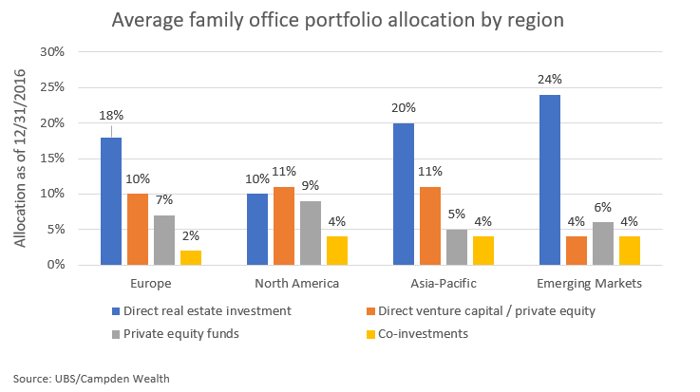

Even among those institutional investors that are pursuing direct strategies, data shows that while many LPs have increased co-investment activity, few have become truly direct investors. The value of co-investment deals has more than doubled since 2012 (totaling $104 billion in 2017), but direct investment has remained essentially flat, at around $10 billion (see chart below).6

A recent Coller Capital survey had similar findings – noting the number of LPs making co-investments in private equity rose from 42% to 55% over the past five years, while the proportion of direct-investing LPs barely grew, from 30% to 31% over the same time period.7

Many organizations recognize they are simply too small to pursue direct investments, while others, including very large ones, are blocked from direct investing by their mandate, requiring external managers for private markets exposure. Becoming more involved in direct investing also requires institutions to adapt investment management, governance, responsible investment guidelines and oversight mechanisms to adequately control their investments. Most of all, the board/trustees and internal investment team need to build a common understanding of objectives, financial and non-financial expectations, and have a clear view on potential outcomes.

Successful direct investing requires new and highly tailored investment processes. Developing the right investment analysis and decision-making steps, in an institution where no similar skills and experience exist, is a huge challenge. Most often, this is achieved through the hiring of experienced staff.

According to LPs familiar with making the transition, institutional allocators should conduct a blank sheet exercise, redesigning the ideal private equity fund structure from scratch to their benefit. Direct-investing teams can be sizeable, and experienced personnel are generally paid higher salaries. Direct investing requires significant investment in new analytical and risk-management tools across a range of asset classes, for example to identify concentration risks at both the individual investment and portfolio levels. Institutions adopting a direct-investment approach will need to manage additional risks which, traditionally, were mitigated or managed primarily by an asset manager: performance risk, operational and market risk, and reputational risk.

How to go direct with success – equipped with the right tools

Even for investors with great deal sourcing and idea generation, coupled with great final decision making, many investors who have primarily allocated to GPs may not have the resources, time, and skill to diligence and monitor direct deals as well as professional managers. Growing disenchantment with the industry’s traditional 2% management fee and 20% performance fee model certainly has been one of the key catalysts driving the transition to direct investments.

Going direct is certainly does not come without challenges. The private-equity market is filled with dry powder, high pricing and crowded competition for assets. Unfortunately, a subscription to a database of 10 million private companies won’t necessarily increase your odds of finding opportunities that align with your strategy or mission.

Sponsor-backed companies (vetted by sophisticated investors), and ensuring you have access to precedent private transactions, cap tables, pre-money valuations and deal multiples to execute the deal with confidence is a good first step to going direct. Ultimately, developing the right investment analysis and having good decision-making tools, is vital to surmounting the challenges in direct investing and critical to success in developing a high performing direct investment process.

1 www.calpers.ca.gov, (July 2018).

2 Boston Consulting Group, A Hands-On Role for Institutional Investors in Private Equity: 2.

3 Sam McMurray, “Troubled by Valuations,” Private Equity International, ISSN 1474–8800 December 2017/January 2018: 6.

4 Campden Family Business, “The Global Family Office Report 2017,” Supplement Issue 72, November 2017: 3-4.

5 Fox Family Office, 2018 Fox Global Investment Survey.

6 McKinsey & Company, “The Rise and Rise of Private Markets,” McKinsey Global Private Markets Review 2018: 24-25.

7 Coller Capital, Global Private Equity Barometer, Winter 2017-18: 8.