Venture Capital

Private Equity

Private Credit Funds

Public Markets

Co-Investors

Family Offices

... and their Portfolio Companies

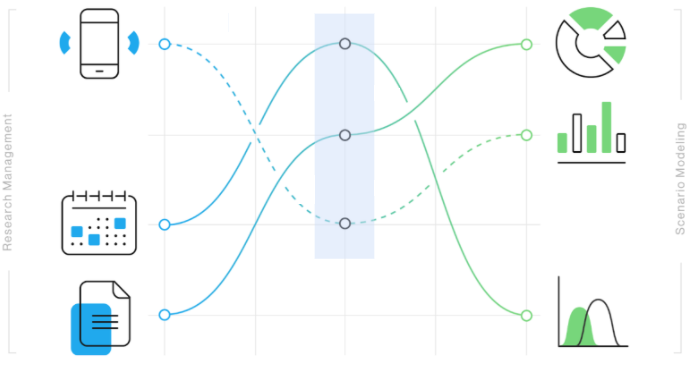

BPN's Collaborative AI Platform is built on patented graph database architecture and makes it practical to Quantify Stories by integrating:

» Research Management

» Scenario Modeling

» Data Visualization

» AI-enabled 'Reading & Writing'

Perfected with National Science Foundation grants, 75,000 hours of software development, and 10 years of continuous use by our founders, the BPN Platform leverages proprietary graph database architecture that was purpose-built for investment analysis and strategic decision-making.

All LLMs can summarize documents, but investment decision-making is about translating stories about competitive differentiation, management execution, and market opportunity into a credible framework for future growth, profitability, and scale. This involves numbers, so we enable you to put a spreadsheet at the center of the AI process and make it easy to create as many cases of future cash flow and valuation as you wish to explore.

AI agents need to be directed and supervised. BPN believes in having a ‘human in the loop’ at three critical points: 1) to "own" the thesis and describe the cases you wish to explore 2) to “own” the “gotta believe” assumptions after seeing all the evidence AI maps to each, and 3) to “own” the conclusion by editing the memo and slidedoc to add nuance and judgment to what AI has produced from the automatic prompts.

Case Builder leverages Evidence Mapper, our AI-enabled research management platform, SlideDoc Maker, our visualization and presentation layer, and Memo Writer, our AI-enabled tool to create a credible first draft memo, to enable your research team, final decisions makers, and any approved 3rd party to:

With BPN, your team can start with any spreadsheet and produce a credible first draft memo, model and slide deck in hours instead of days or weeks. You can easily update it as new information emerges or views change over time.

If you want more scalable frameworks than spreadsheets offer, you can model your entire portfolio using BPN’s proprietary Odds Graph Strategic Scenario Models, built by your team with BPN providing training and support.

BPN can also serve as your Challenge Team, providing independent research and conclusions to compare to your own and delivering a complete memo, model, and SlideDoc that you can adapt with minimal effort.

We’d love to show you the power of BPN’s AI-enabled research and modeling platform, and experienced research team.